First off, some shout-outs are in order: Thanks to three of my favorite Web pubs–New York Times DealBook, Silicon Alley Insider and Valleywag–for linking to the first part of the Creative Capital interview with venture capital pioneer Thomas J. Perkins.

And now, in the promised second part, Perkins talks in depth about how he helped turn around Hewlett-Packard by forming a technology committee (a key move to boosting profits was dumping Intel chips for AMD chips), the pre-texting scandal and why he disagreed with Patty Dunn over practically everything. “Patty Dunn and I didn’t agree on the time of day,” says Perkins.

What struck me in re-reading the interview is the amount of passion that Perkins brings to his job, his love and deep understanding of the technology business, and the way that his battle with HP became personal. In fact, Perkins was so mad at the company for the way it handled the spying scandal that afterwards he bought chose to buy a computer from Lenovo–and not HP!!! “I was kind of mad at HP,” says Perkins.

What did you think about the 60 Minutes interview?

She kept asking me how much money I made. They tape hours. I thought it was OK. I wouldn’t have done it if it wasn’t Leslie Stahl. She kept saying, “This is not going to be about HP.” Of course, we ended up talking a lot about HP. I guess that was inevitable.

How do you think HP is doing?

I have no insider information. I am not on the board and Mark doesn’t call me up and tell me things. From what I can see, it’s in great shape. I have tremendous respect for Mark. He’s really smart and works well. He understands and has cultivated the technology. He has a real good relationship with the chief technology officer, Shane Robison, who I think walks on the water.

How much of the past problems were about leadership and how much were about strategy?

Strategy has changed. We did something unusual at HP when I joined the board. With Carly’s blessing, we set up a technology committee. The combined company was spending pretty close to $5 billion a year on R&D and the board was oblivious to what was going on. It’s a huge amount of money. So we established this committee. It eventually became the whole board. It met the day before the board meetings and really got into the strategic aspect of HP. The support of that committee made it possible for Carly and Mark to take some risks with the understanding that the board was behind us.

What were the risks?

There were three things. HP had had a very liberal technology licensing policy. Any salesman could mortgage the patent portfolio to get the next order. HP was actually paying out $100 million a year in royalties to others, and IBM, with a patent portfolio marginally larger, is taking in $3 billion a year. At the first meeting of the technology committee we changed that. I insisted that every single license had to be signed by Carly Fiorina. It was abrupt but it is working.

The second thing we did was to spend some money and get serious about competing against Dell Direct. Compaq had made a good start but the HP Web site was a nightmare. So we invested pretty heavily in that.

But the most important thing was we encouraged the company to redirect a lot of purchases of microprocessors to AMD from Intel. We slowly and gradually encouraged management to move in that direction. They did. A lot of the improvement of HP’s [profits] is a result of that. It was kind of touch-and-go for a few quarters as to whether we could do it or not, and we did. This is an example of how a board of directors can really help management. When Mark came in he did all that and more.

Is HP now making money off of its patent portfolio?

Yes.

Is it substantial?

Yes, and growing. A lot of these contracts have to expire.

Has Mark made it safe for technologists?

Yes. And you didn’t ask, but in my opinion he knew next to nothing about the spy thing. I apologized to Mark. I told him your job is to fix HP. My job is to fix the board. And I ended up resigning. He called me up and said, “Geez, how could you do this to me?”

Is it fixed now?

I think so. I still have some friends on the board and they say it’s humming.

Have you followed the Lenovo after it purchased the IBM PC company?

Only to buy one of the computers. It’s terrific.

You bought Lenovo instead of an HP?

I did. I also have an HP. I was kind of mad at HP. (Laughs)

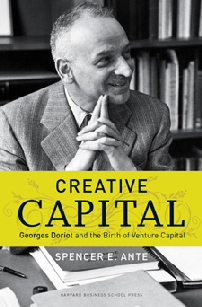

HOW TO BUY CREATIVE CAPITAL: To pre-order Creative Capital and get a 34% discount, click here and go to Amazon

Who serves the role on the board now of championing technology?

There are still a few geeks on the board and there is still a technology committee. The key thing I wanted, and this is against the venture capital model, I wanted Mark to be chairman of the board. A company of that size, he had to be chairman, he had to set the agenda for the board. And that was fundamental difference between Patty Dunn and myself. What does the board do?

You meet at 8:30am and planes have to be caught around 1pm. An audit committee meeting can take an hour and you’ve got all the other committees. And then it’s almost time for lunch and you have a few minutes to talk about competition, strategy, growth rate, succession, the future, fundamentally important stuff. And it tends to get scrunched into a very limited amount of time. And if you don’t even think it’s important, it doesn’t get discussed. So Dunn and I really disagreed on that. I just felt the board had to keep the pressure on–marketing, engineering, succession, competition, doing it on and on.

Also Dunn and I disagreed on what kind of directors we should bring on to the board. I wanted to bring more entrepreneurs from Silicon Valley onto the board. Why? The product life-cycle of Silicon Valley is 18 months. And if you miss a cycle and you’re in real trouble. The sense of urgency about it all is essential to have on the board. Dunn felt we had to bring on people that Wall Street would know and appreciate. So we had a hell of a time.

So you’re saying the board trouble was over the chairman role? What about the pre-texting thing?

Carly Fiorina, not me, has said that the spy scandal was Dunn’s method of restructuring the board. Her primary hope was that I was the leaker. I wasn’t. Turns out she got rid of me and [George] Keyworth at the same time. Carly said that. I don’t dare say that.

So it was not at the root of your disagreement?

It was a lot of things. Dunn and I didn’t agree on the time of day. We started off pretty well. I encouraged her to be chairman. I got her some extra money. I encouraged her to be very active. And we would meet monthly and speak more frequently on the telephone. But it just became really tough going.

How did the relationship sour?

A little bit on all fronts. It was no one big thing. Directors, strategy, compliance experts, how the board spent its time, all these things.

If you had not resigned would all of these things have come out?

If I hadn’t resigned it would not have come out and Patty would still be getting awards for brilliant governance. I didn’t blow the whistle. I tried to get the company to fix it and investigate itself, and primarily stop doing it. If they had taken a serious look at it, I didn’t see how Dunn could continue as chairman.

I thought she could stay on the board. I thought the board would evolve into that conclusion but they didn’t. They stonewalled me for about three and a half months. My lawyer said, “Look Tom, you were chairman of governance. This theoretically all happened under your purview. You’ve got to tell the Securities and Exchange Commission.” So I did. And the SEC went public.

I thought a lot about it. In the end, I felt Dunn did not want to stop being chairman, that’s for sure. And I felt that she was pulling the company into a very bad place. So I decided to fall on my sword.

HOW TO BUY CREATIVE CAPITAL: To pre-order Creative Capital and get a 34% discount, click here and go to Amazon