On April 9, Harvard Business Working Knowledge ran an excerpt from Chapter 7 (“Founding Fathers”) of Creative Capital. Every day, HBSWK features new work from among the more than 200 HBS faculty at the forefront of their diverse fields of expertise. They made an exception for my book, given that Doriot was such a force at HBS.

Here’s the beginning of the excerpt, which centers on the birth of the first successful venture capital firm, American Research and Development.

“The Matchmaker of the Modern Economy”

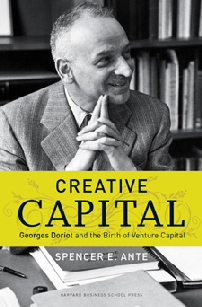

Editor’s Note: A legendary professor at Harvard Business School for 40 years, Georges Doriot was a pivotal player in the founding of the modern venture capital industry. As Spencer E. Ante’s new book notes, venture capital per se is as old as commercial activity itself. What was special about Doriot’s contribution? As Ante writes, “ARD was the first professional venture firm that sought to raise money from nonfamily sources—primarily institutional investors such as insurance companies, educational organizations, and investment trusts. This was a critical development since it greatly expanded the potential amount of money that could be devoted to venture capital.”

Although little has been written about Doriot to date, he was one of the 20th-century’s visionary thinkers. Based on his personal background and intellectual breadth, he quickly grasped the potential of globalization and creativity in business.

A book excerpt follows from Creative Capital: Georges Doriot and the Birth of Venture Capital (Harvard Business School Press).

In hindsight, it makes perfect sense that Boston would serve as a springboard for the venture capital movement. Since its founding in the seventeenth century, Boston has always been fueled by an Enlightenment belief in scientific progress and human perfectibility. It is home to America’s first public school, Boston Latin School (1635), and college, Harvard College (1636). After the American Revolution, Boston became a major shipping port and leader in manufacturing new mechanical or scientific instruments. And the city has always had a revolutionary streak, with movements for women’s suffrage, antislavery, and the American Revolution itself all being launched from its streets.

Georges Doriot embodied these same traits—innovation, risk-taking, and an unwavering belief in human potential. After the war, the stage was set for an explosion of innovation, and Doriot was in a perfect position to light the fuse. As a professor of a leading business school and a director of dozens of companies, Doriot had become an expert in finance and technology manufacturing. And thanks to the war, Doriot has gained a lifetime of experience in organizing and managing new ventures in a pressure-cooker environment.

It is not surprising, then, that the former head of the New England Council’s Venture Capital Subcommittee was ARD’s first choice for president. But Doriot could not take the job, as he was still employed by the Army. So in the interim, the directors named him chairman of the board of directors.[…]

The group of men who founded ARD believed it could crack the conundrum of the risk-less economy. And now that the war was over, they were in a position to do something about it. Money for new enterprises had been restricted, they believed, by the New Deal’s onerous tax system, and by the increasing prominence of ultraconservative investment trusts. Investment trusts and life insurance companies accounted for an expanding portion of the U.S. savings market, but they were reluctant to invest in risky new ventures.

Custom and prudence dictated that the trustees of these firms confined their investments to high-grade bonds or blue-chip securities. [ARD’s acting president Ralph] Flanders, who observed this problem during his presidency of the Federal Reserve Bank, succinctly explained the purpose of ARD in an address he gave in November 1945 before the National Association of Securities Commissioners in Chicago.

“We have the [greatest] number of possibilities for new investments. We have various means for selecting the most attractive possibilities and for spreading the risk on those selected. Does this not furnish a sound business basis for trying new methods of applying development capital? We cannot depend safely for an indefinite time on the expansion of our old big industries alone. We need new strength, energy, and ability from below. We need to marry some small part of our enormous fiduciary resources to the new ideas which are seeking support.”

According to this theory, venture capitalists were like the matchmakers of the modern economy. They would marry money with people and their crazy, new ideas. And the result would be a stronger country with a growing supply of well-paying jobs.

Click here to read the full excerpt.

HOW TO BUY CREATIVE CAPITAL: To pre-order Creative Capital and get a 34% discount, click here and go to Amazon