Before the blockbuster success of Google, Netscape and Apple, there was the first high-tech home run of Digital Equipment Corporation–a story that forms the heart of my book. Below I’ve posted two photos from the archives of Ken Olsen at Gordon College. I am the first person to gain access to these archives.

In 1957, ARD gave $70,000 to the two, young MIT engineers who co-founded Digital—Kenneth P. Olsen and Harlan Anderson—in exchange for 70% of the start-up’s equity. Olsen, who was Digital’s president and undisputed leader, wanted to build smaller, cheaper, and easier-to-use computers that would challenge the glass-encased mainframes of IBM, the dominant computer manufacturer and only one making money. In this sense, DEC was a pre-cursor to the user-friendly machines later pioneered by Apple.

[Ken Olsen at the annual meeting of ARD, surrounded by promotional booths of the other ARD portfolio companies.]

It was a perfect match. In Olsen, Doriot found the archetypal engineer-cum-entrepreneur who was dedicated to making his company a success. “A creative man merely has ideas; a resourceful man makes them practical,” said Doriot. “I look for the resourceful man.” Olsen embodied that ideal. In Doriot, Olsen found a comforting father figure always ready to offer words of encouragement or some bit of wisdom. The fates of these two men would be forever intertwined.

When ARD liquidated its stake in Digital in 1972, the company was worth more than $400 million—yielding a return on their original investment of more than 70,000%! It was the young venture capital industry’s first home run, and it helped make the Route 128 area outside Boston a technological mecca

[The DEC board was stocked with ARD staffers: (left to right) Henry W. Hoagland VP, ARD; John Barnard Jr. general counsel, Massachusetts Investors Trust; Jay W. Forrester, professor, MIT and ARD advisor; William H. Congleton, VP, ARD; Harlan E. Anderson, VP, Co-founder DEC; Kenneth H. Olsen, President, Co-founder DEC; Ms. Dorothy E. Rowe treasurer, ARD; Vernon R. Alden president Ohio University; Arnaud de Vitry, European Enterprise Development; Wayne P. Brobeck, former ARD staffer who became director of consumer relations, Vitro Corp. of America]

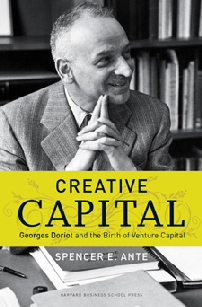

HOW TO BUY CREATIVE CAPITAL: To pre-order Creative Capital and get a 34% discount, click here and go to Amazon