Here’s a story I wrote that gives some perspective on the long and mostly disappointing history of tablet computing.

The Next Big Thing, 20 Years Later

The tech industry thinks the time is right for tablets, thanks to lower prices and friendlier features

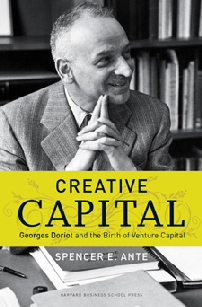

By Spencer E. Ante

If there was a land of misfit gadgets, the tablet computer would be one of its oldest residents. The tech industry, though, refuses to give up on these slate-like portable PCs. Tablets from Hewlett-Packard, Dell, and others were some of the stars at this month’s Consumer Electronics Show in Las Vegas, while the buzz around Apple’s long-awaited entry into the market, due out this spring, is already deafening. “The industry understands better how people can use tablets,” says Roger Kay, president of Endpoint Technologies Associates.

Yet PC makers have been trying to sell consumers on the utility of tablets for decades—with little success. In 2001, Microsoft Chairman Bill Gates predicted that tablets would be the most popular form of PC sold in the U.S. within five years; in 2009, they made up less than 1% of the market, according to estimates from research firm IDC.

The first generation was doomed by a combination of big price tags, short battery life, and clunky interfaces. Tablets’ capabilities have since evolved, as have the tastes of consumers. Portability is paramount, and the latest crop are lighter, boast longer battery life, and better screen technology. Software is more sophisticated, too, and Web connections have improved. “The timing is right for this,” says Philip McKinney, vice-president and chief technology officer of HP’s Personal Systems Group. “We wouldn’t go into a market that we felt wasn’t going to be widely adopted.”