Digital Equipment Corp. cofounder Harlan Anderson, who just turned 80 this month, is publishing his memoirs next month, reports Scott Kirsner in this column.

The book is called Learn, Earn & Return: My Life as a Computer Pioneer, and is being published by Locust Press. And Anderson has also started blogging recently.

(The photo above is of Anderson’s “Employee #2” badge from DEC, which appears on the book’s cover.)

In the book, Anderson writes for the first time about his experiences at DEC during the company’s initial decade, and the events that led to his leaving in 1966 — the same year that DEC became one of the most profitable initial public offerings in Wall Street’s history. Anderson is candid about his relationship with DEC co-founder Ken Olsen: and later, how Olsen’s autocratic leadership style alienated some of the company’s most talented engineers, and ultimately contributed to Anderson’s departure.

He also discusses how American Research and Development, the venture capital firm run by Georges Doriot, financed this groundbreaking startup.

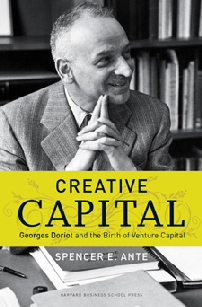

When Digital first took money from American Research & Development, Anderson writes that ARD invested $70,000 for seventy percent of the company. “This deal seems ridiculous and unfair by today’s standards; however, we never contacted an alternative source of capital,” Anderson writes. “We were very naïve and there was very little venture capital money available then. We accepted the offer without any negotiation.” (In the photo is Anderson, sitting in front of Digital’s PDP-6 computer, with Georges Doriot, the founder of ARD.)

Congrats Harlan!