Last night, I updated my Tech Beat blog post and wrote a full-fledged story for the BW.com on Gideon Yu’s departure from Facebook. I still haven’t gotten to the bottom of this surprising ouster but I will continue to look into this over the coming days and weeks.

However, I am glad that I got my scoop out last week reporting that Facebook was having trouble raising money. I didn’t realize it at the time but I was probably very close to breaking open the story on Yu’s departure. In retrospect, I think I fired a warning shot about the company’s growing problems and internal tensions.

Since Facebook has not been forthcoming about Yu’s departure, the company is going to be on the hot seat until the truth is revealed. In a statement, Facebook said it is looking for a new CFO with “public company experience.” While it is true that Yu has never taken a company public before, he does have significant experience working in a senior finance role at a public company, having worked at Yahoo! as senior vice president and treasurer for about four and a half years.

Speaking of which: Does anyone find it strange that the New York Times, Fortune and Wall Street Journal all are burying this story? Fortune ran a glowing cover about Facebook recently, while the New York Times just published a mostly complimentary long feature about the company in its Sunday Business section that skimped over most of its business challenges. Yet in today’s papers and online version of Fortune, Yu’s ouster did not even merit a story!

You’d think the Journal would have run the story in a big way since they got the scoop on Yu’s departure. What does this say about Facebook? Has it jumped the shark?

My own take: The ouster of Yu marks a turning point in the media and investment community’s perception of Facebook. Turmoil seems to be the default mode for this fast-growing phenom now. The honeymoon is officially over. I don’t expect to see any more glowing features in major publications until the company proves it can create a sustainable and profitable business.

Here’s the top of my piece:

Facebook’s CFO Exits: Enter, the Questions

Gideon Yu, the latest top executive to leave the social network, will be tough to replace just as the fast-growing company needs to raise cash

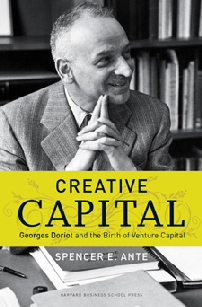

By Spencer E. Ante

Facebook is replacing its chief financial officer, Gideon Yu.

Facebook spokesman Larry Yu confirmed to BusinessWeek that CFO Yu will be leaving the company. Now the big questions are: Why is he out? And who will replace him?

In a statement, Facebook said the company “will be looking for someone with public company experience” and that the fast-growing social network has retained recruiter Spencer Stuart to lead the search for a new CFO.

“Gideon has played an important role in helping us achieve our financial success, building a strong finance team, and establishing the core financial operations of our company,” said Facebook in its statement. “We are grateful to Gideon for his contributions to Facebook and what we are trying to accomplish. Despite the poor economic climate, we are pleased that our financial performance is strong and we are well positioned for the next stage of our growth.”

“NO CURRENT PLANS TO GO PUBLIC”

Facebook’s statement that it is looking for a CFO with more experience in running the financial operations of a public company has led to speculation that the company would accelerate its plans to sell shares in a public offering. But in another statement released to BusinessWeek, spokesman Yu said the company had “no current plans to go public.”

“There are numerous benefits to operating as a private company, especially in this difficult economic environment,” said Yu. “But we’ve always considered the possibility of becoming a public company at some point.”

That raises a further question: If Facebook did not need to hire a new CFO to take the company public in the near term, why is Yu leaving now?

FACEBOOK’S SINKING VALUATION

One reason may have to do with Facebook’s finances. Yu’s departure comes as he was in the process of trying to raise money for the fast-growing startup—one of his primary responsibilities as CFO. Over the last few months, Facebook has been trying to raise as much as $100 million in debt financing to pay for rising technology costs. Although Yu has played an instrumental role in helping Facebook secure more than $500 million in debt and equity financing in the past, he was unable to line up any significant amount of money in the latest round of financing.

Read the rest of the story here.