Tech: The Return of Risk-Taking

Suddenly, there are mergers and acquisitions, IPOs, and investors galore. Will the reenergized industry lead the U.S. out of the Great Recession?

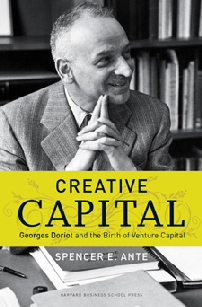

By Spencer E. Ante

In the past few weeks, Jon A. Woodruff, who heads up technology mergers and acquisitions in Goldman Sachs (GS)’ San Francisco office, has seen the mood shift in Silicon Valley. Tech companies are stepping up their dealmaking after a quiet year. In a span of 21 days, Goldman has worked on three major deals—eBay (EBAY)’s sale of Skype, Adobe (ADBE)’s purchase of Omniture (OMTR), and Dell (DELL)’s acquisition of Perot Systems (PER). “People seem more willing to take out their checkbooks again for the right assets,” says Woodruff.

The surge in deal activity is a sign of broader change: Risk-taking is making a comeback in the tech industry. The first three weeks of September saw $19.3 billion in technology mergers and acquisitions, up from $2.5 billion in August and $11 billion last September, according to Thomson Financial. Meanwhile, more companies are filing for initial public offerings, including such closely watched startups as Watertown (Mass.) battery maker A123 Systems. Venture capital investments are perking up, too. The micro-blogging service Twitter has raised a round of funding that gives the nearly revenue-free startup a valuation of $1 billion, according to several reports.

All this activity is being driven by a central idea: The worst of the recession is over, and it’s time to prepare for better times. Economists and other experts say many corporations put off technology investments during the downturn and are likely to step up spending to generate the productivity gains vital to the bottom line. Mark M. Zandi, chief economist of Mark M. Zandi (MCO), predicts that tech spending in the U.S. will increase 4% in 2010 and 10% in 2011, after dropping 10% this year. “I think we are at a turning point for tech,” he says.