One of the things that I did not anticipate about the response to Creative Capital is the degree to which it has been resonating in a downturn. Timing, like in most endeavors, is a pretty crucial factor in book publishing. And I remember thinking before Creative Capital came out in the spring of 2008 that I was glad the U.S. economy still seemed to be doing well.

But then the economy began to lose steam over the summer. The housing market continued to deteriorate. And before you know it, it was September and Lehman Brothers had gone bankrupt and Merrill Lynch sold itself in a fire sale. The U.S. had plunged into a deep and scary recession.

Suddenly, America, a nation of future-oriented amnesiacs, became obsessed with history, and, in particular, with the history of economic crisis. The surprising thing, for me, was that the financial panic changed the way I thought and talked about the book, and the way people viewed it as well.

Virtually overnight, my chapters on the Great Depression, and World War II, and my chronicling of multiple recessions and their inter-relationship with the nation’s entrepreneurial economy in the post-war period took on a new significance. True, one of the key arguments I make in the book was that the venture capital industry itself was born in response to the Great Depression. And that Silicon Valley was created in the midst of the nasty recession of the mid-1970s.

But the more I thought about today’s troubled times, the more I came to see that the history of innovation and economic downturns were in some ways inextricably linked. I came to see that some of the most successful companies were hatched or developed during a downturn. I developed a somewhat contrarian perspective based on my study of the past. And those insights continues to shape my work as a journalist today.

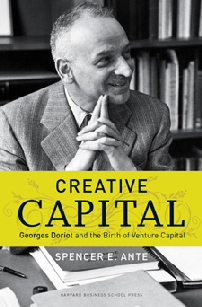

All this is a way of saying I am gratified that readers of the book agree with me that the story of Georges Doriot and the instrumental role he played in building our nation’s entrepreneurial economy still has lessons to offer us in today’s turbulent times. On that note, please check out these two reviews from my Amazon page. Both reviewers gave Creative Capital five stars. One is written by Robert Ackerman, a successful venture capitalist who is managing director and co-founder of Allegis Capital. Their reviews must be having a positive impact. Amazon says there are only three copies of my book left in stock!

The Man of Great Vision!, April 30, 2009

By maryann davenport “Maryann D.” (Southern California) – See all my reviews

Spencer Ante’s biography of Georges Doriot left me cheering my head off! He would look at the mistakes of today’s politicians and bank leaders and tell them exactly what they had done wrong and why and it would not be double talk. This is a great read about a true genius of business who came here from France and tried to teach how to be effective capitalists instead of idiot pretenders. It’s too bad we didn’t learn when we could have. We wouldn’t be in this mess now.

Help other customers find the most helpful reviews

Was this review helpful to you?

Report this | Permalink

Comment

A Must Read – If you care about Innovation and Growth, April 29, 2009

By R. Ackerman “Entrepreneur” (San Francisco) – See all my reviews

In his book Creative Capital – Spencer Ante not only captures the amazing story of a French immigrant (Georges Doriot) and his profound contributions to the United States in business education, government service and launch of the systemic US venture capital industry, he also distills the essence of entrepreneurism and its pivotal role in innovation and the growth of the US technology industry. By embracing creative ideas and pro-actively managing the risk inherent in bringing new technologies to market, Doriot demonstrated that economic growth and wealth creation are at the heart of the venture capital model and two sides of the same coin.

At a time when the US economy is looking for direction and the keys to its future growth and sustainably, Ante’s book is a must read for every politician, business leader and investor who is genuinely looking for the levers through which we can grow and extend our competitive advantage in a global economy. After reading Creative Capital, the question that comes to mind is “how can we proactively encourage more of the innovation that Doriot helped bring to life”.

Ante’s style delivers a great story in an easily readable format punctuated with data and facts that draw clear comparisons to the economic challenges we face to day.